1. Can it be checked.According to the inquiry China Legal Service Network, the house seized will be recorded in the real estate title registration center of the local land bureau of real estate, so it can be checked.

2. You can check the information of the court's subsequent sealing. For the house, go to the real estate registration center to inquire. The vehicle can go to the vehicle management office of the vehicle registration to inquire about the license plate number and then inquire whether the vehicle has been seized by the court.

3. It can be checked, because the equity of the enterprise has been registered in the Bureau of Industry and Commerce, and the Bureau of Industry and Commerce has an archive, and it can still be checked even if it is seized.

1. The guarantee company, also known as the guarantee agency, is a financial institution that provides guarantee services for borrowers. Its main responsibility is to provide guarantees for borrowers, ensure that borrowers fulfill repayment obligations, and reduce the risk of creditors.

2. A guarantee company is an institution that provides guarantee services to individuals or enterprises. Its main business includes loan guarantee, performance guarantee, litigation preservation guarantee, etc. The main role of the guarantee company is to assume the liability for compensation and provide risk protection for the lender when the borrower is unable to fulfill the repayment responsibility.

3. A financial intermediary that mainly provides credit guarantee services for individuals or enterprises. The core business of the guarantee company is to provide customers with credit upgrades and help customers improve their credit ratings in financial transactions such as borrowing and investment, so as to obtain better financing conditions.

4. The financing guarantee company is mainly engaged in loan guarantee, bill acceptance guarantee, trade financing guarantee, project financing guarantee and letter of credit guarantee business. It is established in Hunan Province. The type of enterprise is national ownership, and its industries are resident service, repair and other service industries.

It is a guarantee system. Cloud single insurance is a matching trading platform developed by Gongmuyuan, which aims to solve information matching and transaction problems in the human resources industry. Both parties to the transaction can complete transactions between strange peers on the platform. It is a guarantee system that can effectively guarantee business transactions between labor users.

Financing guarantee refers to the act of the borrower or a third party using certain property as a guarantee for the settlement of the debt. When the borrower is unable to repay the debt or the debt cannot be guaranteed, the financing guarantor performs the guarantee liability in accordance with the agreed or legal procedures.

No need. CCB Cloud Loan is an Internet financial service launched by China Construction Bank, which mainly provides loan services for small, medium and micro enterprises. CCB cloud loans are usually applied for and approved through the online platform. Small, medium and micro enterprises can directly apply for loans through the CCB cloud loan platform.

Guarantee refers to the legal system in order for the parties to promote the debtor to perform the debt to realize the rights of creditors in accordance with the provisions of the law or the agreement of the two parties. Guarantee is usually concluded by both parties. Guarantee activities should follow the principles of equality, voluntariness, fairness, honesty and credit.

Interpretation of cloud factoring: The "cloud factoring" financing model is based on the business principle of commercial factoring, which uses cloud computing technology and combines the actual situation of the export supply chain. In this model, small and medium-sized export enterprises do not need any mortgage guarantee. As long as they have real trade and good credit records, they can apply for financing from banks through relevant websites.

HS code utilization in bonded warehouses-APP, download it now, new users will receive a novice gift pack.

1. Can it be checked.According to the inquiry China Legal Service Network, the house seized will be recorded in the real estate title registration center of the local land bureau of real estate, so it can be checked.

2. You can check the information of the court's subsequent sealing. For the house, go to the real estate registration center to inquire. The vehicle can go to the vehicle management office of the vehicle registration to inquire about the license plate number and then inquire whether the vehicle has been seized by the court.

3. It can be checked, because the equity of the enterprise has been registered in the Bureau of Industry and Commerce, and the Bureau of Industry and Commerce has an archive, and it can still be checked even if it is seized.

1. The guarantee company, also known as the guarantee agency, is a financial institution that provides guarantee services for borrowers. Its main responsibility is to provide guarantees for borrowers, ensure that borrowers fulfill repayment obligations, and reduce the risk of creditors.

2. A guarantee company is an institution that provides guarantee services to individuals or enterprises. Its main business includes loan guarantee, performance guarantee, litigation preservation guarantee, etc. The main role of the guarantee company is to assume the liability for compensation and provide risk protection for the lender when the borrower is unable to fulfill the repayment responsibility.

3. A financial intermediary that mainly provides credit guarantee services for individuals or enterprises. The core business of the guarantee company is to provide customers with credit upgrades and help customers improve their credit ratings in financial transactions such as borrowing and investment, so as to obtain better financing conditions.

4. The financing guarantee company is mainly engaged in loan guarantee, bill acceptance guarantee, trade financing guarantee, project financing guarantee and letter of credit guarantee business. It is established in Hunan Province. The type of enterprise is national ownership, and its industries are resident service, repair and other service industries.

It is a guarantee system. Cloud single insurance is a matching trading platform developed by Gongmuyuan, which aims to solve information matching and transaction problems in the human resources industry. Both parties to the transaction can complete transactions between strange peers on the platform. It is a guarantee system that can effectively guarantee business transactions between labor users.

Financing guarantee refers to the act of the borrower or a third party using certain property as a guarantee for the settlement of the debt. When the borrower is unable to repay the debt or the debt cannot be guaranteed, the financing guarantor performs the guarantee liability in accordance with the agreed or legal procedures.

No need. CCB Cloud Loan is an Internet financial service launched by China Construction Bank, which mainly provides loan services for small, medium and micro enterprises. CCB cloud loans are usually applied for and approved through the online platform. Small, medium and micro enterprises can directly apply for loans through the CCB cloud loan platform.

Guarantee refers to the legal system in order for the parties to promote the debtor to perform the debt to realize the rights of creditors in accordance with the provisions of the law or the agreement of the two parties. Guarantee is usually concluded by both parties. Guarantee activities should follow the principles of equality, voluntariness, fairness, honesty and credit.

Interpretation of cloud factoring: The "cloud factoring" financing model is based on the business principle of commercial factoring, which uses cloud computing technology and combines the actual situation of the export supply chain. In this model, small and medium-sized export enterprises do not need any mortgage guarantee. As long as they have real trade and good credit records, they can apply for financing from banks through relevant websites.

HS code-driven freight route adjustments

author: 2024-12-24 01:42Canada shipment tracking services

author: 2024-12-24 01:39Trade data for risk scoring models

author: 2024-12-24 00:42Exotic spices HS code classification

author: 2024-12-24 00:14How to improve trade compliance

author: 2024-12-24 02:06How to evaluate free trade agreements

author: 2024-12-24 00:20Global trade intelligence forums

author: 2024-12-24 00:17Trade data for enterprise resource planning

author: 2024-12-24 00:06 Composite materials HS code research

Composite materials HS code research

336.25MB

Check How to benchmark import export performance

How to benchmark import export performance

635.69MB

Check HS code-based KPI reporting for trade teams

HS code-based KPI reporting for trade teams

368.53MB

Check Country-wise HS code tariff relief

Country-wise HS code tariff relief

614.36MB

Check HS code-driven supplier performance metrics

HS code-driven supplier performance metrics

554.39MB

Check How to identify monopolistic suppliers

How to identify monopolistic suppliers

499.69MB

Check Industry consolidation via HS code data

Industry consolidation via HS code data

171.98MB

Check Trade data-driven transport mode selection

Trade data-driven transport mode selection

689.35MB

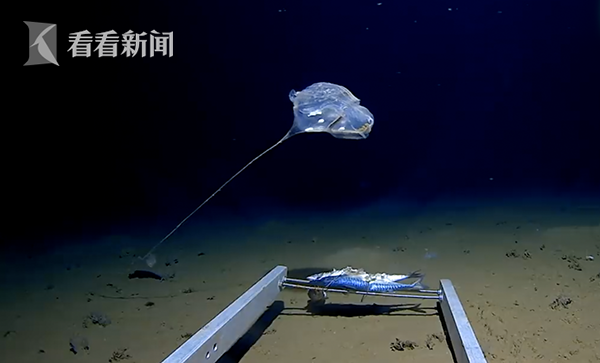

Check Fish and seafood HS code mapping

Fish and seafood HS code mapping

114.92MB

Check Global trade intelligence benchmarks

Global trade intelligence benchmarks

629.63MB

Check HS code utilization in bonded warehouses

HS code utilization in bonded warehouses

627.39MB

Check End-to-end global supply chain solutions

End-to-end global supply chain solutions

572.49MB

Check Global trade e-commerce insights

Global trade e-commerce insights

834.99MB

Check Pharma finished goods HS code references

Pharma finished goods HS code references

494.86MB

Check HS code-based container stowage planning

HS code-based container stowage planning

953.86MB

Check HS code-based supply chain digitization

HS code-based supply chain digitization

671.79MB

Check European Union HS code verification

European Union HS code verification

621.36MB

Check Trade data for strategic pricing

Trade data for strategic pricing

982.82MB

Check HS code-based SLA tracking for vendors

HS code-based SLA tracking for vendors

239.93MB

Check Global supplier scorecard templates

Global supplier scorecard templates

454.72MB

Check Commodity-specific import licensing data

Commodity-specific import licensing data

386.48MB

Check Enhanced shipment documentation verification

Enhanced shipment documentation verification

957.38MB

Check Pet feed HS code verification

Pet feed HS code verification

639.81MB

Check In-depth competitor trade route analysis

In-depth competitor trade route analysis

896.57MB

Check Trade data-driven portfolio management

Trade data-driven portfolio management

365.42MB

Check Bio-based plastics HS code classification

Bio-based plastics HS code classification

936.24MB

Check How to reduce documentation errors

How to reduce documentation errors

747.92MB

Check Predictive trade data cleaning

Predictive trade data cleaning

949.76MB

Check Regional value content by HS code

Regional value content by HS code

717.42MB

Check Global trade intelligence whitepapers

Global trade intelligence whitepapers

488.82MB

Check International trade law reference data

International trade law reference data

965.28MB

Check Industrial lubricants HS code classification

Industrial lubricants HS code classification

143.67MB

Check Advanced customs data integration

Advanced customs data integration

589.56MB

Check How to choose correct HS code in ASEAN

How to choose correct HS code in ASEAN

354.19MB

Check Chemical industry HS code search

Chemical industry HS code search

564.56MB

Check How to analyze customs transaction records

How to analyze customs transaction records

261.96MB

Check

Scan to install

HS code utilization in bonded warehouses to discover more

Netizen comments More

1787 Customizable shipment reports

2024-12-24 02:20 recommend

2011 Predictive models for trade demand

2024-12-24 01:52 recommend

715 HS code-focused compliance audits

2024-12-24 01:44 recommend

132 shipment records analysis

2024-12-24 01:15 recommend

346 Global trade reporting frameworks

2024-12-24 00:21 recommend