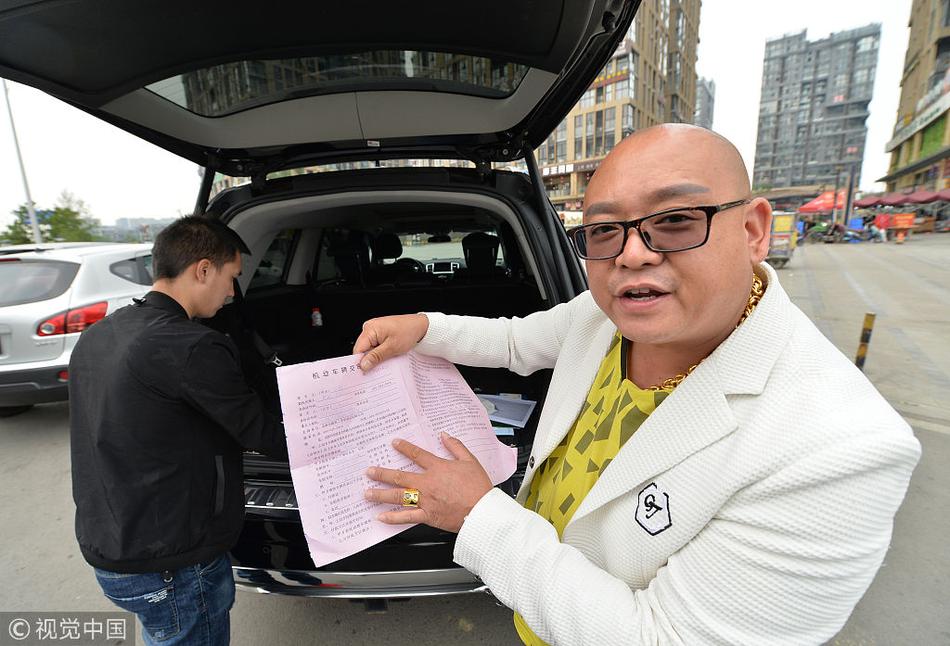

1. The enterprise has the status of an independent legal person and is a domestic enterprise registered with the Administration for Industry and Commerce; the car is in the name of the enterprise; only the legal person or shareholder of the company has the right to apply for a vehicle mortgage on behalf of the enterprise.

2. If you want to apply for a loan with a higher amount and a longer loan term, you will need to use other collateral as collateral. Of course, the collateral must also meet the requirements of the bank. In addition, if your personal income is relatively high and you don't have too many debts, you can also apply for a large loan.

3. Generally speaking, the general conditions are: 1. Original ID card, household registration book or other valid residence documents, and provide a copy; occupational and economic income certificate; car purchase agreement, contract or letter of intent signed with the dealer; other documents required by the cooperative organization.

4. Vehicle registration certificate Vehicle registration certificate is an important document for vehicle mortgage, which needs to be provided to the bank as an important attachment to the loan contract. At the same time, the vehicle registration certificate is also the main basis for verifying vehicle information and vehicle ownership. Vehicle driving license Vehicle driving license is also one of the necessary materials for loans.

5. Vehicle mortgage conditions: [Urgently need money? Find Anmeitu! If you have a car, you can get a loan!] Age requirement: The borrower must be between 18 and 65 years old and have full civil capacity.

1. For the company's name, the company's legal person can apply for the vehicle Please give me a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long. However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

2. Company cars can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

3. Enterprise vehicles can be mortgaged.The legal representative can mortgage the enterprise's vehicle to apply for a loan, but it should be especially noted that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

4. Can I borrow a car in the name of the company? Yes. For the car in the name of the company, the legal person of the company can apply for a mortgage.

5. If you can't get a loan anyway, you won't charge money! Good luck! Can the company's car be mortgaged? The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

6. The company can borrow money to buy a car. In the name of the company, the loan photo, tax registration certificate, legal person's ID card and other documents can be submitted. And when individual users borrow money to buy a car, they need an ID card. In addition, if you borrow money to buy a car in the name of the company, you also need to meet the application conditions for a car loan.

The car of the company can be mortgaged, but a loan must be applied for in the name of the company.

Enterprise vehicles can be mortgaged. The legal representative can mortgage the vehicle of the enterprise to apply for a loan, but special attention should be paid to the fact that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

A car under the name of the company, the legal person of the company can use the vehicle to apply for a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long. However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

The company's car can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

1. Can the company's car be mortgaged. For the car in the name of the company, the legal person of the company can apply for a mortgage.

2. For a car under the name of the company, the legal person of the company can use the vehicle to apply for a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long.However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

3. The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

4. Company cars can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

5. Enterprise vehicles can be mortgaged. The legal representative can mortgage the vehicle of the enterprise to apply for a loan, but special attention should be paid to the fact that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

The loan company is legal.According to Hualu's inquiry, a private car loan company is a non-bank financial institution that uses cars as collateral to provide loans to borrowers. This type of company usually cooperates with banks to ensure that borrowers' loans are fully covered.

The car loan product of Sunshine Insurance is the car loan business of a regular financial institution. There is no problem with reliability, and there is also a guarantee when the loan is settled and released. The interest rate is not low, and the monthly interest rate is about one point. The products of car mortgages can be simply divided into bank products, credit insurance products and loan company products.

There are indeed some formal and informal institutions in Chengdu's car mortgage market. For borrowers, it is very important to choose a formal institution, because it involves their own interests and rights.

It will be investigated and punished, and the vehicle inspection will also be very troublesome.Is private car mortgage legal? Legal. But it must be within the scope permitted by law, otherwise it will not be protected. At present, in China, banks generally do not provide car mortgage services. Such services generally need to be applied for by private professional credit institutions.

As long as the lender agrees and the collateral is owned by the lender, it is legal. But it must be within the scope permitted by law, otherwise it will not be protected. At present, in China, banks generally do not provide car mortgage services. Such services generally need to be applied for by private professional credit institutions.

How to access restricted trade data-APP, download it now, new users will receive a novice gift pack.

1. The enterprise has the status of an independent legal person and is a domestic enterprise registered with the Administration for Industry and Commerce; the car is in the name of the enterprise; only the legal person or shareholder of the company has the right to apply for a vehicle mortgage on behalf of the enterprise.

2. If you want to apply for a loan with a higher amount and a longer loan term, you will need to use other collateral as collateral. Of course, the collateral must also meet the requirements of the bank. In addition, if your personal income is relatively high and you don't have too many debts, you can also apply for a large loan.

3. Generally speaking, the general conditions are: 1. Original ID card, household registration book or other valid residence documents, and provide a copy; occupational and economic income certificate; car purchase agreement, contract or letter of intent signed with the dealer; other documents required by the cooperative organization.

4. Vehicle registration certificate Vehicle registration certificate is an important document for vehicle mortgage, which needs to be provided to the bank as an important attachment to the loan contract. At the same time, the vehicle registration certificate is also the main basis for verifying vehicle information and vehicle ownership. Vehicle driving license Vehicle driving license is also one of the necessary materials for loans.

5. Vehicle mortgage conditions: [Urgently need money? Find Anmeitu! If you have a car, you can get a loan!] Age requirement: The borrower must be between 18 and 65 years old and have full civil capacity.

1. For the company's name, the company's legal person can apply for the vehicle Please give me a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long. However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

2. Company cars can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

3. Enterprise vehicles can be mortgaged.The legal representative can mortgage the enterprise's vehicle to apply for a loan, but it should be especially noted that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

4. Can I borrow a car in the name of the company? Yes. For the car in the name of the company, the legal person of the company can apply for a mortgage.

5. If you can't get a loan anyway, you won't charge money! Good luck! Can the company's car be mortgaged? The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

6. The company can borrow money to buy a car. In the name of the company, the loan photo, tax registration certificate, legal person's ID card and other documents can be submitted. And when individual users borrow money to buy a car, they need an ID card. In addition, if you borrow money to buy a car in the name of the company, you also need to meet the application conditions for a car loan.

The car of the company can be mortgaged, but a loan must be applied for in the name of the company.

Enterprise vehicles can be mortgaged. The legal representative can mortgage the vehicle of the enterprise to apply for a loan, but special attention should be paid to the fact that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

A car under the name of the company, the legal person of the company can use the vehicle to apply for a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long. However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

The company's car can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

1. Can the company's car be mortgaged. For the car in the name of the company, the legal person of the company can apply for a mortgage.

2. For a car under the name of the company, the legal person of the company can use the vehicle to apply for a mortgage. The vehicle applies for a mortgage as collateral. Because the vehicle is a consumable, the loan amount is usually not too high, and the loan term will not be very long.However, it is no problem to apply for a loan from the bank as collateral for the vehicle.

3. The company's car can be mortgaged, but you have to apply for a loan in the name of the company.

4. Company cars can be mortgaged. The legal person of the company can apply for a loan with the mortgage of the company's car, but it should be noted that the car itself is a consumable, the approved loan amount is not high, and the loan term cannot be too long.

5. Enterprise vehicles can be mortgaged. The legal representative can mortgage the vehicle of the enterprise to apply for a loan, but special attention should be paid to the fact that the vehicle is actually a consumable. The loan credit limit is not high, and the loan term cannot be too long.

The loan company is legal.According to Hualu's inquiry, a private car loan company is a non-bank financial institution that uses cars as collateral to provide loans to borrowers. This type of company usually cooperates with banks to ensure that borrowers' loans are fully covered.

The car loan product of Sunshine Insurance is the car loan business of a regular financial institution. There is no problem with reliability, and there is also a guarantee when the loan is settled and released. The interest rate is not low, and the monthly interest rate is about one point. The products of car mortgages can be simply divided into bank products, credit insurance products and loan company products.

There are indeed some formal and informal institutions in Chengdu's car mortgage market. For borrowers, it is very important to choose a formal institution, because it involves their own interests and rights.

It will be investigated and punished, and the vehicle inspection will also be very troublesome.Is private car mortgage legal? Legal. But it must be within the scope permitted by law, otherwise it will not be protected. At present, in China, banks generally do not provide car mortgage services. Such services generally need to be applied for by private professional credit institutions.

As long as the lender agrees and the collateral is owned by the lender, it is legal. But it must be within the scope permitted by law, otherwise it will not be protected. At present, in China, banks generally do not provide car mortgage services. Such services generally need to be applied for by private professional credit institutions.

How to find authorized economic operators

author: 2024-12-24 01:03Sustainable trade data analytics

author: 2024-12-23 23:48How to track competitor import export data

author: 2024-12-23 23:26HS code analytics for niche markets

author: 2024-12-23 23:20How to reduce customs compliance risk

author: 2024-12-24 01:33Best global trade intelligence for SMEs

author: 2024-12-24 00:48How to calculate landed costs accurately

author: 2024-12-24 00:47Export subsidies linked to HS codes

author: 2024-12-24 00:29 Global trade documentation standards

Global trade documentation standards

224.46MB

Check Trade data for pharmaceuticals supply chain

Trade data for pharmaceuticals supply chain

826.91MB

Check Global trade certificate verification

Global trade certificate verification

348.12MB

Check HS code for artisanal goods

HS code for artisanal goods

954.61MB

Check HS code-based global benchmarking

HS code-based global benchmarking

869.42MB

Check Granular HS code detail for compliance officers

Granular HS code detail for compliance officers

569.15MB

Check Textile yarn HS code mapping

Textile yarn HS code mapping

636.72MB

Check HS code-based landed cost calculations

HS code-based landed cost calculations

537.54MB

Check UK HS code duty optimization

UK HS code duty optimization

567.83MB

Check Industry-wise trade data breakdowns

Industry-wise trade data breakdowns

932.44MB

Check Global trade data-driven asset utilization

Global trade data-driven asset utilization

785.77MB

Check HS code-based vendor qualification

HS code-based vendor qualification

598.42MB

Check Trade data-based price benchmarks

Trade data-based price benchmarks

175.19MB

Check HS code verification for exporters

HS code verification for exporters

549.13MB

Check How to identify top export opportunities

How to identify top export opportunities

543.39MB

Check trade compliance solutions

trade compliance solutions

377.58MB

Check How to identify top importing countries

How to identify top importing countries

687.46MB

Check End-to-end shipment management

End-to-end shipment management

781.57MB

Check Agriculture trade data by HS code

Agriculture trade data by HS code

671.89MB

Check Textile finishing HS code analysis

Textile finishing HS code analysis

411.34MB

Check HS code-based reclassification services

HS code-based reclassification services

825.16MB

Check HS code-based forecasting for exports

HS code-based forecasting for exports

324.26MB

Check Pharma supply chain HS code checks

Pharma supply chain HS code checks

621.56MB

Check Global import export freight indexes

Global import export freight indexes

215.78MB

Check Best trade data solutions for startups

Best trade data solutions for startups

458.27MB

Check Trade data-driven portfolio management

Trade data-driven portfolio management

298.56MB

Check Predictive analytics for supplier risks

Predictive analytics for supplier risks

238.76MB

Check Tariff reduction opportunity analysis

Tariff reduction opportunity analysis

673.16MB

Check How to map complex products to HS codes

How to map complex products to HS codes

656.27MB

Check Petroleum products HS code insights

Petroleum products HS code insights

685.56MB

Check Trade data for GDP correlation analysis

Trade data for GDP correlation analysis

329.56MB

Check How to track competitor import export data

How to track competitor import export data

388.92MB

Check Global import export freight indexes

Global import export freight indexes

359.83MB

Check Industry-specific tariff code reference

Industry-specific tariff code reference

478.16MB

Check Global import export data subscription

Global import export data subscription

834.67MB

Check How to find reliable global suppliers

How to find reliable global suppliers

929.91MB

Check

Scan to install

How to access restricted trade data to discover more

Netizen comments More

2141 Australia import export data visualization

2024-12-24 01:24 recommend

2514 Real-time supply-demand matching

2024-12-24 01:24 recommend

435 Comprehensive supplier audit data

2024-12-24 01:23 recommend

2610 Global trade credit risk analysis

2024-12-24 00:41 recommend

2616 Optimizing distribution using HS code data

2024-12-23 23:23 recommend